|

This help topic explains how to use the Advanced eBilling Editor to manage expenses for an invoice, including adjustments made to individual expenses. Specifically, this topic explains how to:

· Edit expense data

· Add a new expense

· Delete an expense

· Edit an expense adjustment

· Add an expense adjustment

· Delete an expense adjustment

Expenses Data

Editable data in the Expenses workspace includes:

|

Date:

|

The date of the activity that generated the expense.

|

|

Tkpr:

|

Identifies the person who performed the activity that generated the expense, and the rate charged per hour for that person's services.

|

|

Type:

|

Unit means the expense is calculated using the Quantity, Rate and Adjustments values.

Fixed means the expense is a set amount (not based on other expense data).

|

|

Code:

|

A code that identifies an expense category such as photocopying services, filing fees, mileage, etc.

|

|

Quantity:

|

The number of items related to the expense such as number of photocopies, number of documents filed, miles driven, etc.

|

|

Rate:

|

The amount charged per expensed item.

|

|

Description:

|

Describes the activity that generated the expense.

|

To edit data in the Expenses workspace, follow these steps:

1. Right-click on the desired row of expense data and select the Edit option.

.png)

This action displays the Edit Expense screen.

2. Click (or tab to) the data field you want to edit. (Double-clicking highlights all field text for editing.)

3. Edit the data by overwriting the existing text. For the Date field, you can also use the field box arrows .png) to select a date. For the Tkpr (Timekeeper) and Type fields, use the list box to select a value. Note that if you edit the Quantity or Rate field, the eBilling Editor automatically recalculates and displays the Amount and Total values. to select a date. For the Tkpr (Timekeeper) and Type fields, use the list box to select a value. Note that if you edit the Quantity or Rate field, the eBilling Editor automatically recalculates and displays the Amount and Total values.

4. Click OK. The Advanced eBilling Editor then refreshes with the updated expense data.

5. Continue updating additional invoice data, (law firm data, invoice information, matter details, timekeepers, fees, extended fields, adjustments) if desired. If you are finished making changes, click Save to display the following message:

.png)

6. Click OK to close the message box.

To add a new expense to the invoice, follow these steps:

1. Right-click on a row of expense data and select the Add New option.

.png)

This action displays the Add Expense screen with a non-editable number populated in the Id field. (The first new expense is assigned Id number 99999991. Subsequent new expenses are assigned 99999992, 99999993, and so forth.)

2. Click (or tab to) each editable field and enter the new expense data. For the Date field, you can also use the field box arrows .png) to select a date. For the Tkpr (Timekeeper) and Type fields, use the list box to select a value. Note that once you enter a value for the Quantity and Rate fields, the eBilling Editor automatically calculates and displays the Amount and Total values. to select a date. For the Tkpr (Timekeeper) and Type fields, use the list box to select a value. Note that once you enter a value for the Quantity and Rate fields, the eBilling Editor automatically calculates and displays the Amount and Total values.

3. Click OK. The Advanced eBilling Editor then refreshes with the new expense added to the list.

To delete an expense from the invoice, follow these steps:

1. Right-click on the row of expense data you want to delete and select the Delete option.

This action displays a confirmation message similar to the following:

2. Click Yes to confirm the deletion. The Advanced eBilling Editor then refreshes with the selected expense removed from the list.

Expense Adjustment Data

Editable data in the Expense Adjustments workspace includes:

|

Class:

|

ADJ (Adjustment) is an amount subtracted from the expense. You must enter the adjustment amount with a minus sign to indicate an expense reduction.

CREDIT is an amount added to the expense.

|

|

Type:

|

Flat means the adjustment or credit is a set amount (not based on other expense data).

Percent means the adjustment or credit is a percentage of the expense total.

|

|

Percent:

|

Defines the adjustment or credit as a percentage of the total expense amount (for example, 5.00%). You must calculate this percentage and include its value in the Amount data field.

|

|

Amount:

|

Specifies an amount for the expense adjustment or credit (for example, an adjustment of -100.00 or a credit of 100.00)

|

|

Description:

|

Describes the reason for the adjustment or credit.

|

To edit an expense adjustment, follow these steps:

1. Select the row of expense data related to the expense adjustment you want to edit. This action populates the Expense Adjustments workspace with all the adjustments for that expense.

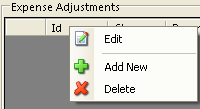

2. Select the expense adjustment you want to edit, and then right-click to display a pop-up menu.

3. Select the Edit option to display the Edit Adjustment screen.

4. Click (or tab to) the data field you want to edit. (Double-clicking highlights all field text for editing.)

5. Edit the data by overwriting the existing text. For the Class and Type fields, use the list box to select a value.

6. Click Update. The Advanced eBilling Editor then refreshes the adjustment data to reflect your edits. If you edited the Percent or Amount fields, the expense total also refreshes with the recalculated value.

To add an expense adjustment, follow these steps:

1. Select the row of expense data you want to adjust.

2. Place the cursor in the Expense Adjustments workspace and right-click to display a pop-up menu.

3. Select the Add New option.

This action displays the Add Adjustment screen with a non-editable number populated in the Adjustment Id field. (The first new adjustment is assigned Id number 99999991. Subsequent new adjustments are assigned 99999992, 99999993, and so forth.)

4. Click (or tab to) each editable field and enter the new adjustment data. For the Class and Type fields, use the list box to select a value. If you select Flat as the adjustment type, enter the amount of the credit or adjustment in the Amount field. If you select Percent as the adjustment type, enter the credit or adjustment as a percentage of the total expense in the Percentage field and the calculated value of the percentage in the Amount field.

|

|

To enter an expense reduction, include a minus sign (-) before the number in the Amount field. For example, to record a $20 expense reduction, enter -20.00.

|

5. Click OK. The Advanced eBilling Editor then refreshes with the new adjustment added and the expense total recalculated to reflect the adjustment.

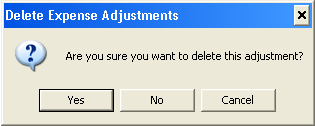

To delete an expense adjustment, follow these steps:

1. Select the row of expense data related to the expense adjustment you want to delete. This action populates the Expense Adjustments workspace with all the adjustments for that expense.

2. Select the expense adjustment you want to delete, and then right-click to display a pop-up menu.

3. Select the Delete option. This action displays a confirmation message similar to the following:

4. Click Yes to confirm the deletion. The Advanced eBilling Editor then refreshes with the selected adjustment removed and the expense total recalculated to reflect the deleted adjustment.

Related Topics

.png) Editing Law Firm Information Editing Law Firm Information

.png) Editing Invoice Information Editing Invoice Information

.png) Editing Matter Details Editing Matter Details

.png) Editing Timekeeper Data Editing Timekeeper Data

.png) Managing Fees Managing Fees

.png) Editing Extended Fields Editing Extended Fields

.png) Editing, Adding and Deleting Matter Adjustments Editing, Adding and Deleting Matter Adjustments

|